If you pay taxes on property in Upper Brookville, you may have the right to appeal your property’s annual assessment. Nassau County’s Assessment Review Commission – ARC – will review your application. This link, How to Appeal Your Assessment, can get you started.

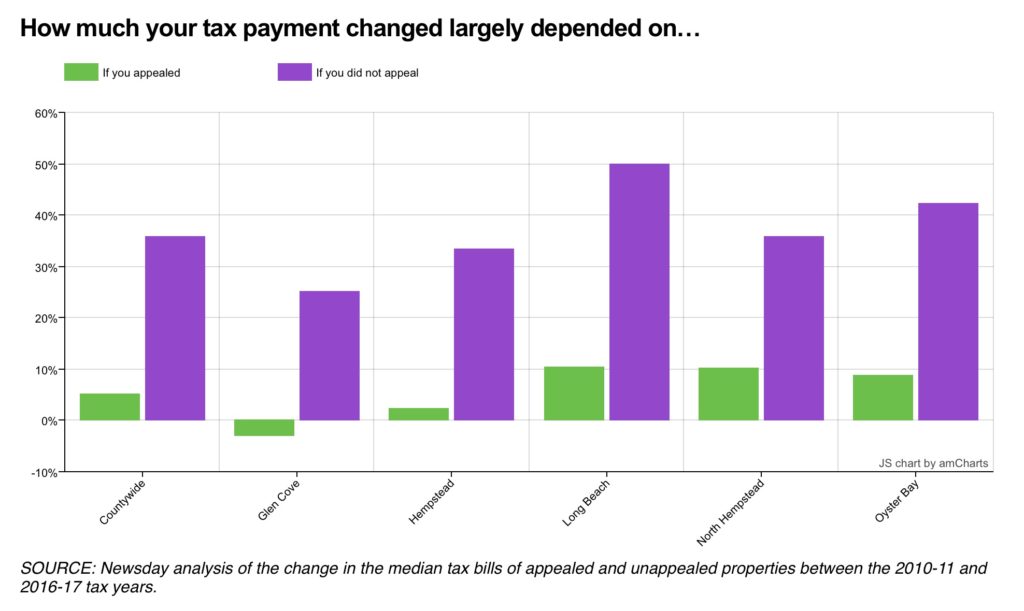

A February 17th Newsday article analyzed the impact of appealing your assessment in: Nassau tax assessment system- Can it be fixed? The article reports from 2010/11 to 2016/17 tax years, taxes increased more in Oyster Bay for those who did not appeal, and the increase was less if the resident appealed. Note that this is a complex process and the results of individual appeals can vary significantly.

There is a new assessment for each year. The time to appeal a new assessment ends before the taxes based on that assessment are billed. If you disagree with the most recent assessment, appeal it, even if you are awaiting determination of an appeal you filed last year.

If you want ARC to review your property’s assessment, you must file an appeal

- The application requires only basic information about your property. You can file online.

- You are not required to use an attorney. If you hired a representative to challenge a prior assessment, you are free to change representatives or file for yourself for review of the new assessment.

- The Assessment Review Commission may reduce your assessment as appropriate.

- The Assessment Review Commission will never increase the assessment.

- You should decide whether to appeal the new assessment by comparing the Department of Assessment’s adjusted market value with your own estimate of your property’s current market value.

- The Assessment Review Commission may also correct your tax class and hear your appeal if you were denied an exemption.

- There is no fee to file with ARC.

The following brochure explains the process:

This YouTube Video also explains the process:

Nassau County Controller’s Office Tutorial on How to Grieve Your Assessment